16 or over for a cash ISA. The Stocks and Shares ISA savings amount for the 20212022 6 April to 5 April tax year is 20000.

What You Need To Know About Your Isa Allowance Wealthify Com

Innovative Finance ISA You can invest all your Stocks and Shares ISA allowance into one account or spread it across your different ISA accounts but you must stay within the annual 20000 limit.

Cash isa and stocks and shares isa allowance. Youre free to split your ISA allowance any way you like across a Stocks and Shares ISA Cash ISA Lifetime ISA maximum of 4000 and an Innovative Finance ISA as long as you stay within the. If you want to learn more weve written about Cash ISAs vs Stocks Shares ISAs. The ISA allowance or annual contribution limit for for the 202122 tax year is 20000.

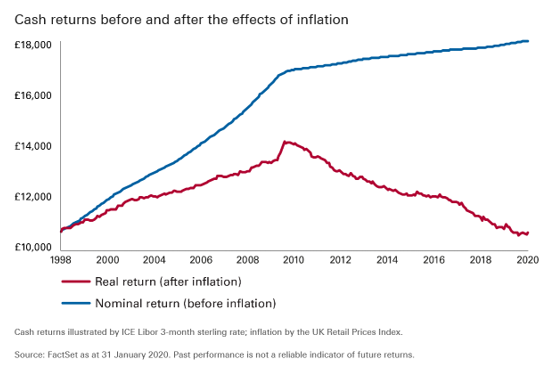

Average cash ISA rate. Remember cash saved in a cash ISA may lose value if inflation rises. After the tax year finishes you can keep your money on a tax-free basis whilst the money remains in the ISA account.

18 or over but under 40 for a Lifetime ISA. You can transfer existing cash Isas and stocks and shares Isas into a new stocks and shares Isa without affecting your allowance. So the total untaxed amount invested per year in all your combined ISAs cannot surpass 20000.

Savers can deposit the full 20000 into a cash stocks and shares or innovative finance Isa or any mix of the three types. ISA transfers can be made from a cash ISA to a Stocks and Shares ISA and vice versa and savings from previous years can be split between a cash ISA and a Stocks and Shares ISA Under current cash ISA transfer rules providers must allow ISA transfers out of a cash ISA but are under no obligation to allow transfers in. Yes you can as long as theyre different types meaning its possible to pay into a Cash ISA and a Stocks and Shares ISA in the same tax year.

This means that you can theoretically take out a cash ISA a stocks a shares IS a Lifetime ISA and an IF ISA in the same year. 18 or over for a stocks and shares or innovative finance ISA. Opening more than one Stocks and Shares ISA.

When is the ISA deadline. If youre saving up to buy property there is also the Help to Buy Isa and for those aged 18-40 the lifetime Isa. The savings limit for Junior ISAs is 9000.

To bring it right back around to where we started cash ISAs and stocks and shares ISAs both have their place. Beyond a cash ISA your options are a stocks and shares ISA an innovative finance ISA and a lifetime ISA. Because of the potential returns from a stocks and shares ISA there might be a desire to open up more than one stocks and shares ISA.

April 2019 to April 2020. ISA contribution limits are one of the most confusing parts of the ISA structure especially since many people use them as a savings and investment account. Theres more than one type of ISA available Cash ISA Lifetime ISA Innovative Finance ISA and Stocks Shares ISA.

You can contribute to a Stocks and Shares ISA and a Cash ISA in the same tax year as long as the total amount you contribute does not go over your annual allowance of 20000. Cash ISA or stocks and shares ISA. If you have existing Isas they do not contribute towards your current Isa allowance.

You can spread your ISA allowance between a Cash Stocks and Shares or Innovative Finance ISA or simply place all your savings in to one of these types of accounts. The exception to the rule is the Lifetime ISA where the limit is 4000. So double-check that youre not going over the limit.

Stocks and Shares ISA. One example of how to save a lump sum of 20000 could be to save 16000 in a. So while you can put the full 20000 allowance in to a cash ISA a stocks shares ISA or an innovative finance ISA here youre limited to 4000.

Take some time to think about your savings goals first then decide whether a cash ISA or a different type of ISA would be most ideal. Lifetime ISAs were launched in April 2017 to help people save for their first home or retirement. However you can only open one type of each Isa per year.

There are two different types of Lifetime ISA. The contribution can be split between the cash and stocks and shares elements. ISA stands for Individual Savings Account and there are 4 main types available.

Who can open an ISA. If youve already started investing in a stocks and shares ISA in a tax year but want to move you can transfer your ISA to a different provider but this will close your original ISA account. If you do pay into a cash ISA and stocks and shares ISA in the same year bear in mind your 20000 allowance covers your contributions across both.

You can only have one of each. You can have more than one ISA and yes you can pay into a cash ISA and a stocks and shares ISA. Each year HMRC sets an ISA allowance and its the total amount of money you can put into ISAs that tax year.

Mar 2020 to Mar 2021. How much you can save into an ISA each tax year is determined by the ISA allowance. The ISA allowance for the 202122 tax year is 20000.

You must also be either. However make sure your total contributions dont exceed your annual allowance of 20000. Saving money in a cash ISA for.

But with Cash ISAs and Investment ISAs also known as Stocks and Shares ISAs being the most popular weve listed their main features to help you understand the difference between them. This means you can put 10000 of your 20000 limit in a stocks and shares ISA and 10000 in a cash ISA but not split this across two different stocks and shares ISAs. Both of these Isas have lower annual limits - but whatever you pay in will be taken from your 20000 allowance.

You can invest all 20000 in a stocks and shares ISA or spread it across different ISA accounts such as a cash ISA or Lifetime ISA. For example you could contribute 5000 to a Cash ISA with NatWest and 15000 to a Stocks and Shares ISA with HSBC in the same tax year. However your ISA allowance of 20000 a year will cover all your ISAs.

A Lifetime ISA is like supercharging a Cash ISA or Stocks and Shares ISA you get a massive 25 bonus from the government on the cash you put in. So one cash Isa stocks and shares Isa etc. Savers can put their 20000 annual allowance into one type of ISA or spread their money across the range of ISAs.

But theyre a bit of an oddity in the ISA spectrum as you only have a 4000 limit each tax year. This years performance across stocks shares ISAs is in clear contrast to the 201920 tax year when on average over that period there was a loss of -133 explained Rachel Springall finance expert at Moneyfactscouk. Today I am going to be looking at the Stocks and Shares ISA allowance and the benefits of using one.

The Isa Basics Every Saver Should Know Isa Special The Sunday Times

No comments