There are two types of Junior ISA a Junior cash ISA and a Junior stocks and shares ISA. About the cheapest platform for SIPPs.

Best Stocks And Shares Isa 2022 5 Top Performing Isas

These are cash-based deposit savings accounts.

Junior stocks and shares isa comparison. You can only open one junior cash ISA and one junior shares ISA per tax year and you can split the 9000 allowance between them as you wish. Any money you save for your child is protected against dropping in value. An Ethical Junior ISA JISA is a tax-efficient savings account for children that invests with an ethical reasonability in mind.

11 rows Junior Stocks Shares ISA Best Buy Table. You can manage the account and view its balance in branch. Compare projected returns and charges on 1000s of the best stocks and shares Junior ISAs from all the top providers.

A Junior Stocks and Shares ISA account JISA is a tax-efficient way to save for your childs future as you pay no income tax or capital gains tax on your investments. Once your child reaches 18 they can access the money in their Junior ISA. Theyre a tax efficient way of saving up for your childs future whether you want to regularly save for them make one off payments or share the details so eager grandparents and friends can save up for them.

Ethical Junior ISAs are a type of Stocks and Shares JISA meaning that they invest in the stock market via funds shares and other investment vehicles. Select the best junior stocks and shares ISA to make the most of your tax free allowance this year. Stocks Shares ISAs are available to UK residents aged 18 and over.

As an experienced ISA provider were trusted by over 240000 ISA customers as at 30 June 2020. Get started today for just 999 per month. Junior Stocks and Shares ISAs are tax-free investment accounts for children opened and managed by a parent or legal guardian.

Fidelity is a popular choice for parents looking for the best. Ii was named Best Stocks Shares ISA Provider at the 2021 Online Personal Wealth Awards. Interest rates tend to be higher on childrens ISAs than adult ones.

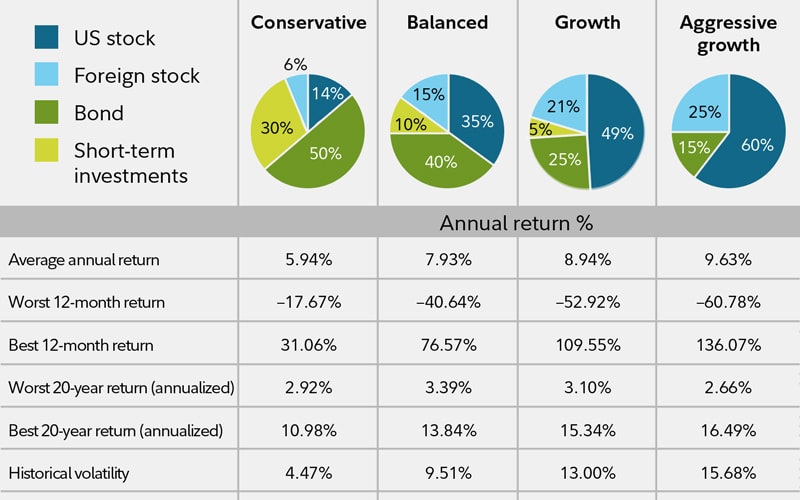

An Ethical JISAs underlying investments can either be self. This offers the potential for a greater return but your childs money could also fall in value so there is some risk attached. While cash junior ISAs are considered less risky if you are setting money aside for your child from the time it is born and are happy to tolerate fluctuations that come with investing in the stock market a stocks and shares ISA may be a better option.

When comparing Junior stocks and shares ISAs you need to decide where you want to invest either in funds or stocks and shares. A Stocks Shares ISA is a tax-efficient investment account. Compare Junior Stocks Shares ISA Accounts.

Junior stocks and shares ISAs invest money in the stock. Compare junior investment ISA providers and read our reviews to get the best childrens stocks and shares ISA so they can earn the best returns with the lowest costs. Cash Junior ISA C JISA Stocks and Shares Junior ISA SS JISA sometimes referred to as a Junior Investment ISA A child can have one or both types of Junior ISA but the overall savings limit applies to both added together ie.

Stocks and Shares Junior ISAs are riskier as the value can go up and down depending on whats happening in the stock market. Top five junior stocks and shares ISAs 1. Tax-efficient and award-winning Stocks and Shares Junior ISA Invest with as little as 30 per month or 500 upfront.

We offer a stocks and shares ISA with the flexibility to choose contribution and withdrawal dates from 1 28 of the month and the ability to replenish withdrawals within the same tax year. There are 2 types of Junior ISA. So if you want to deposit 4500 into a junior cash ISA and 4500 in a junior stocks shares ISA you can do this providing you dont go over the 9000 limit.

To open a stocks and shares junior ISA the best place to go is an online platform a convenient one-stop-shop. Whether a cash ISA or stocks shares ISA is better for you depends on whether youre willing to risk your money investing and when youll need access to the cash. Neither you nor your child will have to pay tax on the interest earned.

Junior stocks and shares ISAs are very similar to adult ISAs except theyre for youngsters. ISAs for children have a limit this tax year of 9000 for new contributions in a tax year. Junior cash ISAs earn interest in the same way as regular savings accounts.

Compare ETFs by using over 80 performance and risk metrics. You cant exceed that 4368 annual total. This can be paid into a Junior Cash ISA a Junior Stocks and Shares ISA or any combination of the two.

Ad FundVisualizer is a free powerful ETF and fund comparison tool created for advisors. There is also a 12 dealing charge by postal instruction or 8 by online instruction. When you invest within a Stocks Shares ISA all the capital gains and income generated from your investments are completely tax-free.

Unlike adult ISAs a child is not allowed to have more than one junior ISA of each type. Invest your childs money in a Junior Stocks and Shares ISA. Funds Most investors choose funds as they invest in a basket of stocks shares bonds and other investments in line with the investment aims of the chosen fund.

A cash ISA may be better if you want a short-term option and dont want to risk losing any money. Among the cheapest offerings around to save for your child until your child turns. The 11 stocks shares ISA need-to-knows.

Junior Stocks and Shares ISA. A stocks and shares junior ISA invests in shares bonds or funds and is also tax-efficient. Stocks and Shares ISAs tend to outperform cash options over extended periods of time but you must always consider the element of risk.

For those under the age of 18 the Junior ISA is available. Fidelity Personal Investing Cost Focus portfolio. Wesleyan has been looking after the financial interests of members since 1841 and the With Profits fund is managed by its award-winning investment team.

Compare Junior Stocks and Shares ISAs. A 25 annual charge applies. The Junior ISA allowance for the 202122 tax year is 9000 and you have until 5 April 2022 to use it.

We have narrowed down the best Junior stocks and shares ISAs which let you invest money for your child in a tax-efficient wrapper.

Best Junior Stocks And Shares Isas Times Money Mentor

No comments