A cash ISA may be better if you want a short-term option and dont want to risk losing any money 2. The account must be opened by the childs parent or guardian but anyone can contribute once the account has been opened.

Student Guide Isas Financially Mint

Depending on your individual circumstances and financial goals one of the two ISAs might make more sense for you.

Cash isa to stocks and shares isa rules. This means you can save a total of 20000 into one Cash ISA or Stocks Shares ISA or one innovative ISA or 4000 into one Lifetime ISA in a single tax year. Cash ISA transfer in rules allow you to transfer just part of a previous tax years Cash ISA or Stocks and Shares ISA If you transfer ISAs from previous tax years then any amount can be transferred and it does not impact your current tax years ISA allowance. This rule change is good news for those coming up to retirement age or who no longer want to have their money exposed to the stock market.

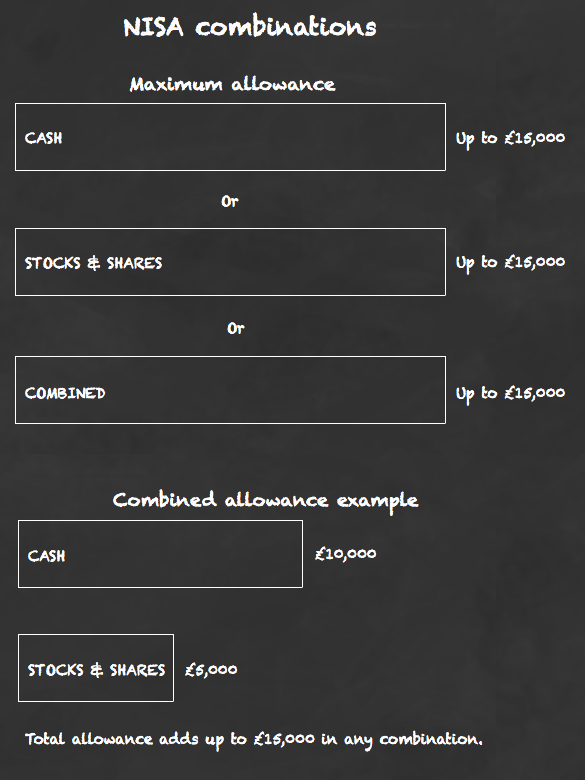

Savers can put their 20000 annual allowance into one type of ISA or spread their money across the range of ISAs. But you cant add money to two stocks and shares ISAs in the same year. There are six different types of ISAs available to savers.

Transferring from a cash Isa to a stocks and shares Isa can take longer guidance from HMRC states that it could take up to 30 days. These rules allow people to invest in markets via a stocks and shares ISA to save in cash via a cash ISA to put money away for later in life or for a first-time property purchase via a Lifetime ISA LISA to put money aside for a child under 18 via a Junior ISA JISA or to invest by peer-to-peer lending in an Innovative Finance ISA. Its the limit on how much money you can save and invest through Individual Savings Accounts ISAs in a single tax year.

3 innovative finance ISA. However make sure your total contributions dont exceed your annual allowance of 20000. But even though you can have both doesnt necessarily mean you should.

For example you could contribute 5000 to a Cash ISA with NatWest and 15000 to a Stocks and Shares ISA with HSBC in the same tax year. You should invest for the long term to ride out any bumps in the market 3. Money saved into Isas either stocks.

So the total untaxed amount invested per year in all your combined ISAs cannot surpass 20000. You can have more than one ISA and yes you can pay into a cash ISA and a stocks and shares ISA. However your ISA allowance of 20000 a year will cover all your ISAs.

If you want to pay into a new investment Isa and transfer money in from your existing cash Isa you must only use this Isa for new contributions this tax year. You could open a Cash ISA and contribute to this within the same tax year as long as you dont go over the maximum combined ISA allowance of 20000 across these accounts. Theres more than one type of ISA available Cash ISA Lifetime ISA Innovative Finance ISA and Stocks Shares ISA.

The 11 stocks shares ISA need-to-knows 1. Cash to stocks and shares Isa. From July 2014 it has been possible to transfer your Stocks and Shares ISA to a Cash ISA.

2 stocks and shares ISA. There are different types of ISAs each having different rules. The lifetime Isa is exempt from this rule - regardless of whether you have a.

This means you can only make new deposits into one cash Isa if you have a Help to Buy Isa this counts as being your cash Isa option one stocks and shares Isa one innovative finance Isa and one lifetime Isa. The Stocks and Shares ISA rules state that you may only contribute to one Stocks and Shares ISA within any given tax year. So while you can put the full 20000 allowance in to a cash ISA a stocks shares ISA or an innovative finance ISA here youre limited to 4000.

The rule to know here is that while you can have more than one ISA you can only open and add money to one of each type of ISA in the same tax year. If you have a Help to Buy Isa paying into this will count as using up your cash Isa option for the year. Money deposited into a stocks and shares ISA is invested which means that investors risk not making any returns on their investments at all and in some cases could lose their initial capital as well.

5 Help to Buy ISA and 6 junior ISA. But with Cash ISAs and Investment ISAs also known as Stocks and Shares ISAs being the most popular weve listed their main features to help you understand the difference between them. A Lifetime ISA is like supercharging a Cash ISA or Stocks and Shares ISA you get a massive 25 bonus from the government on the cash you put in.

Although there is the potential to gain a higher return on investments with a stocks and shares ISA compared to a cash ISA these ISAs also have a higher risk. There are two different types of Lifetime ISA. The exception to the rule is the Lifetime ISA where.

Also there is no tax on profits made on share price increases interest earned on. You can hold a cash ISA and a stocks and shares ISA at the same time and they dont even have to be with the same provider. Youll need to fill out an Isa transfer form with your intended stocks and shares Isa provider who will arrange the transfer.

You can invest in almost anything in a stocks shares ISA but most investors stick to shares and funds 4. For example you can add money to one cash ISA and one stocks and shares ISA in a year. You could save 11000 in a cash ISA 2000 in a stocks and shares ISA 3000 in an innovative finance ISA and 4000 in a Lifetime ISA in one tax year.

The withdrawal does not even need to be reported on any income tax forms. If you want to learn more weve written about Cash ISAs vs Stocks Shares ISAs. The ISA allowance for the 20212022 tax year is 20000.

ISAs come in many guises. Yes you can as long as theyre different types meaning its possible to pay into a Cash ISA and a Stocks and Shares ISA in the same tax year. You can contribute to a Stocks and Shares ISA and a Cash ISA in the same tax year as long as the total amount you contribute does not go over your annual allowance of 20000.

The two most common types are Cash ISAs and Stocks and Shares ISAs or Investment ISAs as they are also known. A Cash or Stocks Shares ISA account or both can be opened for a child subject to the annual allowance which is 9000 for the 202122 tax year. Any amount withdrawn from a Cash ISA a Stocks and Shares ISA or a Lifetime ISA is not taxable.

Theres Junior ISAs JISAs for those under 18 Help to Buy ISAs for first-time buyers Innovative Finance ISAs for people using Peer to Peer lending platforms and the Lifetime ISA for people saving for later life or a house deposit. But theyre a bit of an oddity in the ISA spectrum as you only have a 4000 limit each tax year. Your ISAs will not close when the tax.

What You Need To Know About Your Isa Allowance Wealthify Com

No comments