Top self-invested stocks and shares ISAs. This wrapper means you have no tax to pay on any dividends growth interest or income you.

As such you need to do some homework to ensure the platform is right for you.

Stocks and shares isa. Fractional investing available select customers only. As noted earlier investing in a stocks and shares ISA means signing up with a UK stock broker. A stocks and shares ISA offers the potential for higher returns than a cash deposit and you can.

With HSBC you can start. Choose what youd like to invest in from ready-made portfolios to funds or shares. Discover new trading opportunities.

A stocks and shares ISA is a type of account known as a tax wrapper which can be set up with an online fund supermarket stockbroker wealth manager robo-adviser or bank. What is a Stocks Shares ISA. A stocks and shares LISA is different because it typically invests in company shares usually through an investment fund.

Stocks Shares ISAs are classed as tax. Ad Sharpen your Skills with Innovative Tools Built by Traders for Traders. Find out how stocks and shares Isas work how to pick the best provider - and how to switch if youre not happy with the service youre getting.

Stocks and shares Isas offer the. A Stocks Shares ISA also known as an Investment ISA is an Individual Savings Account that lets you invest your money into the stock market. Choose your payments Pay as much as you.

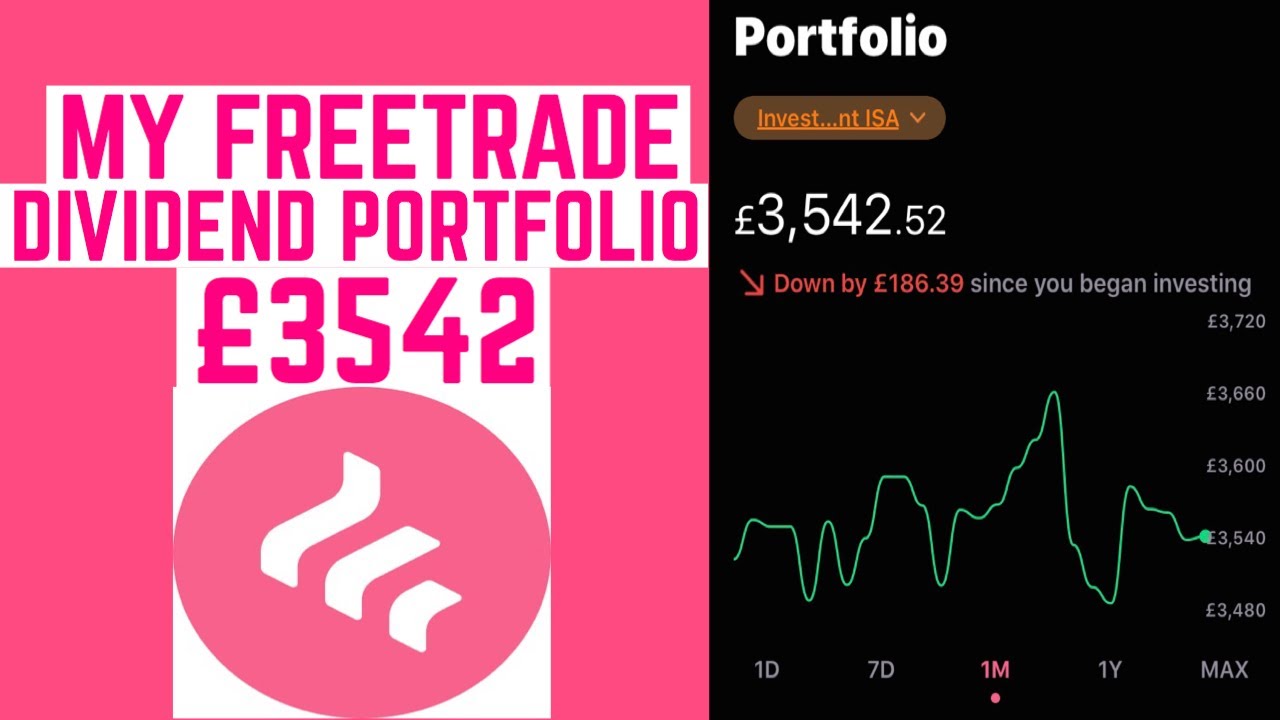

Once youve decided what to invest in youll be able to open a. Select your funds Pick from our Easy or DIY options depending on your preferences. Your Stocks and Shares ISA account costs a fee of 3month and there are no commissions for placing trades.

Choose an investment style that works for you. Barclays offers access to. Fractional investing available select customers only.

Straightforward transparent and designed by experts. A stocks shares ISA also known as an investment ISA is an Individual Savings Account in which you can hold investments in a wide range of shares funds trusts and bonds. Its a type of savings vehicle that allows you to invest in funds or stocks while.

Open a stocks and shares ISA. Vanguard Asset Management Personal Investing in the UK. You can use our fees calculator to compare against other ISA providers.

The value of your LISA therefore goes up and down according to. First a quick reminder of what a Stocks Shares ISA does. Wide Range Of Investment Choices Including Options Futures and Forex.

ISA Charges Do it yourself with our Stocks Shares ISA 1. Ad Build a diversified portfolio with crypto stocks. Think of a Stocks and Shares ISA as a wrapper that sits around the investments in your portfolio.

This can be invested in cash or stocks and shares or a combination of both. Ad Build a diversified portfolio with crypto stocks. Those who want a wide range of investments and low fees.

Discover new trading opportunities. Why we rate it. Open or Transfer an ISA With investment your capital is at.

No comments