Vanguard Stocks and shares ISA where you can invest up to 20000 per year tax-free. Is the Vanguard stocks and shares ISA right for you.

Vanguard Vs Hargreaves Lansdown Best Investment Service

After successfully running money for investors in Italy since 2011 Moneyfarm launched in the UK back in 2016 following the rise in demand for investment ISAs robo-advice cheap stocks and shares ISAs and pensions for beginners.

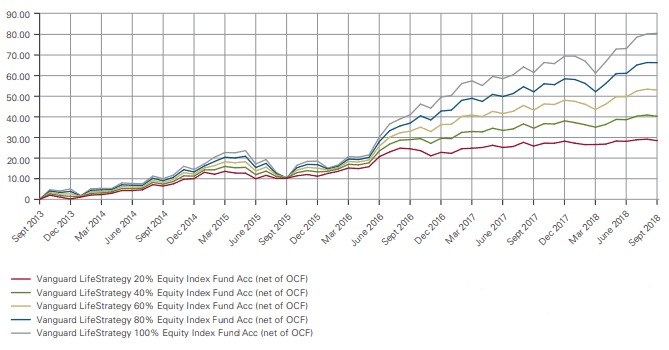

Vanguard stocks and shares isa review. Cash ISAs to our Stocks and Shares ISA Junior ISAs full transfers only Stocks and Shares ISAs full or partial transfers Vanguard Rules for Transferring the ISA. 63 rows Vanguard stocks and shares ISA. You get 5 options of mixing the shares and bonds 2080 4060 6040 8020 0r 100 shares.

Stocks and Shares ISA. Trading and funding the account were easy. It also offers the LifeStrategy range of portfolio funds.

The great thing about Vanguard is that they also provide a stocks and shares ISA account meaning you can invest in one of their funds and still make efficient tax savings. When you are transferring the previous tax years ISA you choose to either transfer it in. Top-rated share dealing account or stocks shares ISA we.

The most effective solution is to use Vanguard GIA to build a pot using the monthly investing and then to periodically transfer the money in to an iWeb ISA. I would like to open a stocks and shares ISA to help support our pensions. Vanguards low-cost model and large fund selection make the broker a good choice for long-term investors but the firm lacks the kind of.

Moneyfarm is an interesting proposition for those trying to find the best investment ISA or pension to invest in. Vanguard is a weird exception to the rule in that the site is better once logged in than the other way around. You may also send us a secure message from within your Vanguard account.

ISAs have a 20000 annual contribution limit for 2021 and you must be at least 18 years old to make an ISA. For example youll only pay an annual fee of 015 up to a maximum of 375. Vanguard ISAs are classic stocks and share ISAs that let you invest on a tax-deferred basis for retirement.

If you are unsure whether these are suitable for you please speak to a financial adviser. Vanguard has amazingly low fees and is very straight forward and simple to invest through their stocks and shares ISA. The only thing that lets them down is not having an App but their website is pretty good and easy to understand Browse a list of Vanguard funds including performance details for both index and active mutual funds.

If youre looking for the best stocks and shares ISA on the market Fidelity Vanguard or Barclays could be a good place to start. If you want to transfer the current tax year ISA you can only transfer them in full. For our stocks and shares ISA comparison we have focused on.

In terms of fees they are also one of the most competitive in the fund dealing market. Vanguard is authorised and regulated by the Financial Conduct Authority and currently holds investments. It works smoothly enough and the screens are easy to read compute and move around.

Vanguard Asset Management Personal Investing in the UK. This should help you decideThis video should help you find out as I not only review the Vanguard Stocks. The Stocks and shares ISA have a 015 annual account fee and no extra charges for things like payments deals or anything else.

Pros Cons and How It Compares. Hi Junko thank you for leaving us a review and we are sorry your ISA transfer has taken significantly longer than wed normally expect. Vanguard Investor Review.

You cant buy funds from other companies shares or investment trusts. All investments up to 20000 in. It offers general investing accounts stocks and shares Isas junior Isas and Sipps.

This website is designed to give you information on the products and services offered by Vanguard. Vanguard is one of the worlds largest fund managers offering low cost investing accounts stocks and shares ISAs junior ISAs and SIPPS. Vanguard was founded in 1975 and launched their DIY UK platform Vanguard Investor in 2017.

Edward Sheldon is interested in Vanguard funds and highlights what he believes are three of the best funds for now and years to come. Vanguard do a lifestyle strategy one so dont need to choose funds myself. Vanguards platform only allows you to buy Vanguard funds of which there are around 75 covering a range of regions assets and investment styles.

My strategy is going to. A stocks and shares ISA is typically a good place to start if youre new to investing as there are tax benefits that you dont get with general investment accounts. Vanguard funds are fine for what they are but there can be better option as mentioned by other posters the HSBC version for example.

Vanguard Junior ISA where you can invest up to 9000 per year for a child. Past performance is not a reliable indicator of future returns. As I have argued before stock and shares ISA are a good investment because they are tax-efficient flexible and challenging to raid.

In this video I review my portfolio on Vanguard talk about my yearly results in 2021 and plans for my stocks and shares ISA in 2022. Please give us a call on 0800 587 0460 and a member of the team will investigate this. My spouse has a vanguard sipp which I set up recently and find it easy to manage.

Vanguard Review 2022. Get the low-down on investing with guides views and market news.

Vanguard Stocks Shares Isa A Review Looking After Your Pennies

No comments