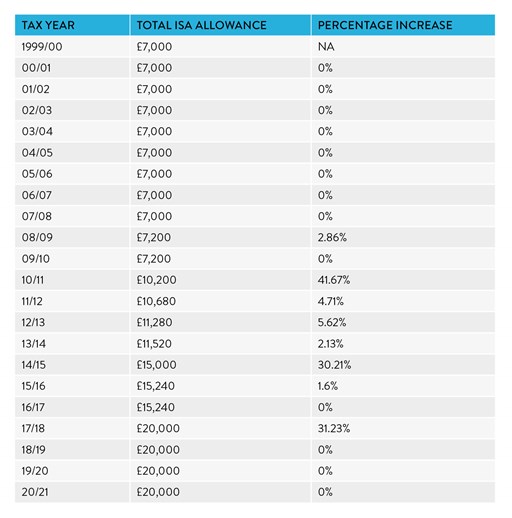

The annual ISA allowance for the 2021-2022 tax year is 20000. ISA Allowance The ISA Allowance changes annually.

Your Two Minute Guide To Isas Moneylens

An ISA Allowance works differently from a PSA.

Isa tax free allowance explained. During the 2021-22 tax year which runs from 6 April 2021 to 5 April 2022 you can place up to 20000 into an Isa. Each tax year you get an ISA allowance which sets out the maximum you can save within the tax-free wrapper. Whilst you can have as many different types of ISA as you like you can only pay into one types of ISA per year.

If you are a basic rate taxpayer your Personal Savings Allowance lets you save 1000 a year tax-free. This is the same Isa allowance as the 2020-21 tax year. An ISA is a type of savings account where the interest is tax-free and the Cash ISA is as the name suggests one for cash savings rather than investments.

If you pay tax at the higher rate of 40 this sum reduces to 500. Because you dont pay any Income Tax or Capital Gains Tax on any interest or profits you make from an ISA the Government limits how much you can put into one. What is the ISA allowance.

Instead of being taxed based on how much interest youve earned an ISA Allowance allows you to save up to 20000 a year tax-free. For 202122 the allowance is 20000. You can save up to 20000 in one type of account or split the allowance across some or all of the other types.

You can pay in up to 4000 in each tax year and the government will add a 1. You can split it across different types of ISAs say a cash ISA and a. Its just a savings or investment account you never pay tax on.

The letters stand for individual savings account. You can only put money into one cash ISA andor one stocks and shares ISA andor. There are different types of ISAs and the annual allowance is currently 20000 for the 202122 tax year.

In comparison for earnings outside an ISA for the tax year 202122 only your first 2000 of dividends earned in the tax year are tax free. The ISA allowance for the current tax year is 20000. The current ISA allowance is 20000.

Your ISA allowance is the most you can save in an ISA in each tax year. You can choose whether you want to invest the wh. And while the name is fancy the concept is simple.

How you make use of the ISA allowance is up to you. Beyond this allowance you pay tax on dividends. The 2021-22 ISA allowance is 20000 per person You have until 5th April 2022 to make use of it HMRC set the allowance every year.

This is the amount that you can pay into your ISA s in that tax year. The total amount you can save in ISAs in the current tax year is 20000. Some non-ISA savings accounts let you save up to 5 million every year.

Theres an annual ISA. The tax free ISA allowance is the maximum amount currently 20000 for 202021 you can save every year between April 6 one year and April 5 the following year. The lifetime Isa is for adults aged 18-39 only designed to help them buy their first home or save for retirement.

You are not allowed to put money into more than one of the same type of ISA in the. You can only pay 4000 into your Lifetime ISA in a tax year. Each tax year you are able to save your money into one of each kind of ISA.

ISAs allow you to save. This is known as the ISA allowance. There is a limit set by the Government as to how much you can put into an ISA every tax year which is called your ISA Allowance.

Isas Can Spell Big Returns If You Pick The Right Type Isas The Guardian

No comments