This is in addition to your ISA allowance so you can use both. In the 2021 to 2022 tax year the maximum you can save in ISAs is 20000 There are 4 types of ISA.

Everything You Need To Know About The Junior Isa Allowance Wealthify Com

File Your Taxes Absolutely Free From Any Device.

Tax free isa allowance. This relates to your ISA allowance ie. The tax free ISA allowance is the maximum amount currently 20000 for 202021 you can save every year between April 6 one year and April 5 the following year. A tax-free allowance is a sum of money you can save or invest in one year without having to pay any tax.

HR Block Offers A Wide Range Of Tax Prep Services To Help You Get Your Maximum Refund. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. This means if you have an ISA worth 40000.

The government adds a 25 bonus at the end of every tax. Beyond this allowance you pay tax on dividends. ISAs JISAs LISAs and pensions are examples of products that have.

As long as you fill out. However your spouse or civil partner can inherit your ISAs tax-free status as a one-off boost. Get Your Max Refund Today.

This is exactly the same as the limit for the 2021-2022 tax. The ISA allowance is different from the personal allowance for the self-employed. HR Block Offers A Wide Range Of Tax Prep Services To Help You Get Your Maximum Refund.

How much you can put into your ISA. For the 2021-22 tax year everyone has an Isa allowance of 20000 - this is the maximum amount youre allowed to pay into Isas between 6 April 2021 and 5 April 2022. Does transferring your ISA to a new ISA affect your ISA limit.

It means that if you take out 2000 to pay for something for instance unexpected car repairs and then. A lifetime ISA allows you to save or invest up to 4000 of your annual ISA allowance either as a lump sum or via regular payments. A tax-free ISA individual savings account allows you to put your ISA allowance to work and optimize potential returns on your money by sheltering it from income tax tax on profits and.

The tax free allowance for an Individual Savings Account or ISA for this Tax year is 20000. See How Easy It Is With TurboTax. Start your 2021 Tax Return.

You can save tax-free with Individual Savings Accounts ISAs. You can choose whether you want to invest the whole lot in to one type of ISA or whether you. When you die your spouse or civil.

Ad Prepare and File 2022 Taxes Yourself Online Or With A Tax Pro In-Office Or Virtually. Ad Prepare and File 2022 Taxes Yourself Online Or With A Tax Pro In-Office Or Virtually. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

The savings allowance is an amount of interest that you can earn without having to pay tax on it. Ad Our free federal filing includes life changes and advanced tax situations. This Isa allowance is.

For the current 202122 tax year the maximum you can save in an ISA is 20000. The ISA limit for the 2022-2023 tax year will be 20000 which means you can put a maximum of 20000 into your ISAs that tax year. File Your Taxes Absolutely Free From Any Device.

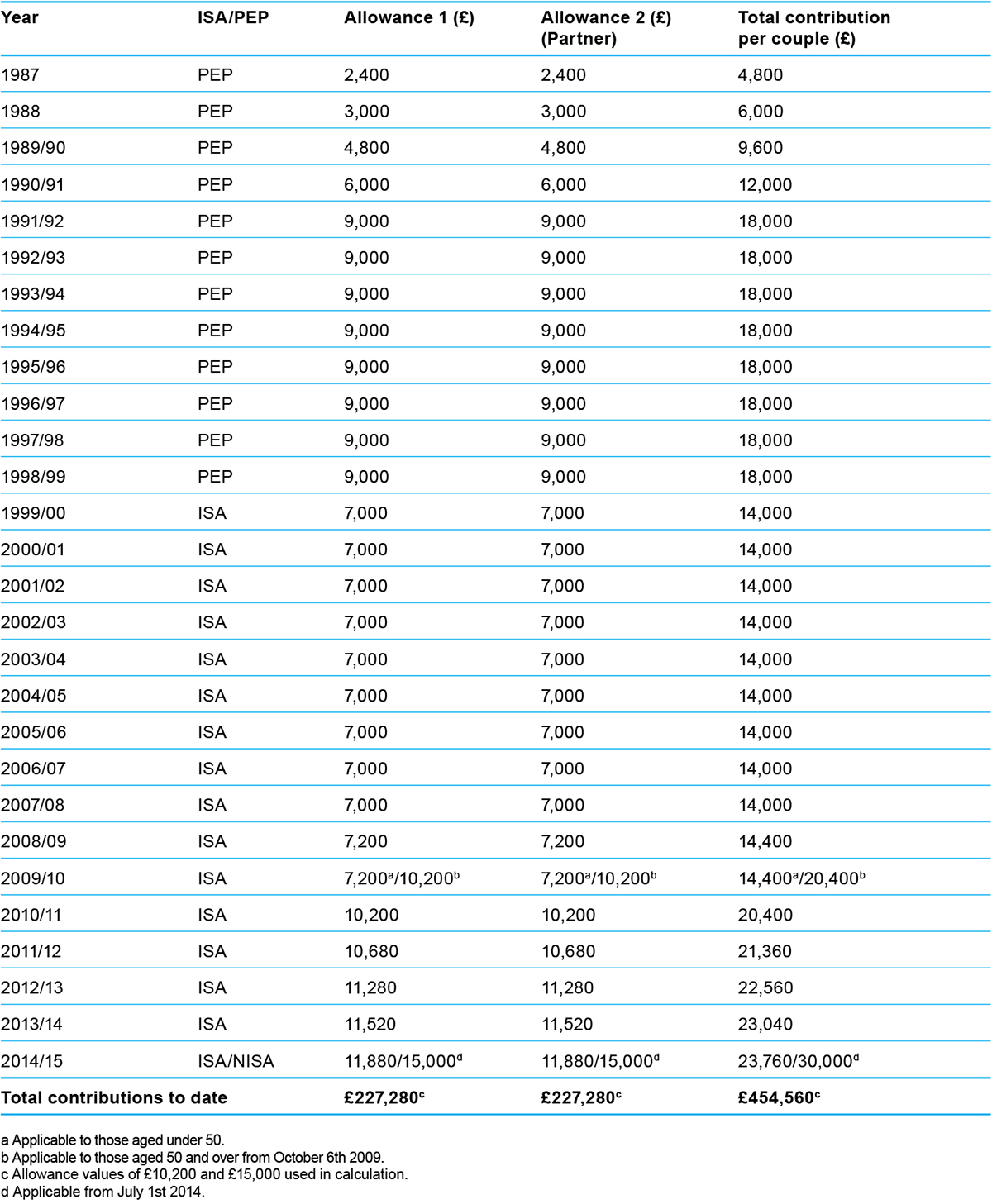

ISA contribution limits are one of the most confusing parts of the ISA structure especially since many people use them as a savings and investment account. If the interest you earn on your savings exceeds the personal savings allowance or youre an additional-rate taxpayer and dont receive this allowance at all you could cut your tax. See How Easy It Is With TurboTax.

This is called your ISA allowance and its 20000 for the current tax year. Get Your Max Refund Today. In comparison for earnings outside an ISA for the tax year 202122 only your first 2000 of dividends earned in the tax year are tax free.

Your Annual Isa Nisa Allowance Use It Or Lose It

No comments