Proposed rules and regulations. The maximum that you can invest in an ISA for any one tax year is 20000.

Cash Isas Compare The Best Cash Isa Rates Moneysupermarket

190 Power of intervention.

Investment isa rules and regulations. If you are making regul ar savings direct debit payments. You do not even need to declare them on your tax return. KIID means the Key Investor Information Document.

18 or over but under 40 for a Lifetime ISA. CA 288918 David Cohen VS. Rules on Central Counter Party CCP c.

The Unicorn Investment Funds N ISA only allows investment in a Stoc ks and Shares ISA. Coordinate the competitive bid process for benefit providers. You can put in up to 4000 each year until youre 50.

Up to four people can be Joint Holders. Securities Act ISA 2007 and the Rules and Regulations made pursuant thereto. All investments within a Stocks and Shares ISA are 100 tax-free.

You must make your first payment into your ISA before youre 40. 6 Things You Need To Review. Each Fund has a KIID which you must read before investing in that Fund.

For the current 202122 tax year the maximum you can save in an ISA is 20000. Aged 16 or over for a cash ISA. Thirteen states Alaska Arizona California Florida Illinois Kentucky Michigan New Jersey New York Ohio Rhode Island Wisconsin and Wyoming and three territories Guam Northern Mariana.

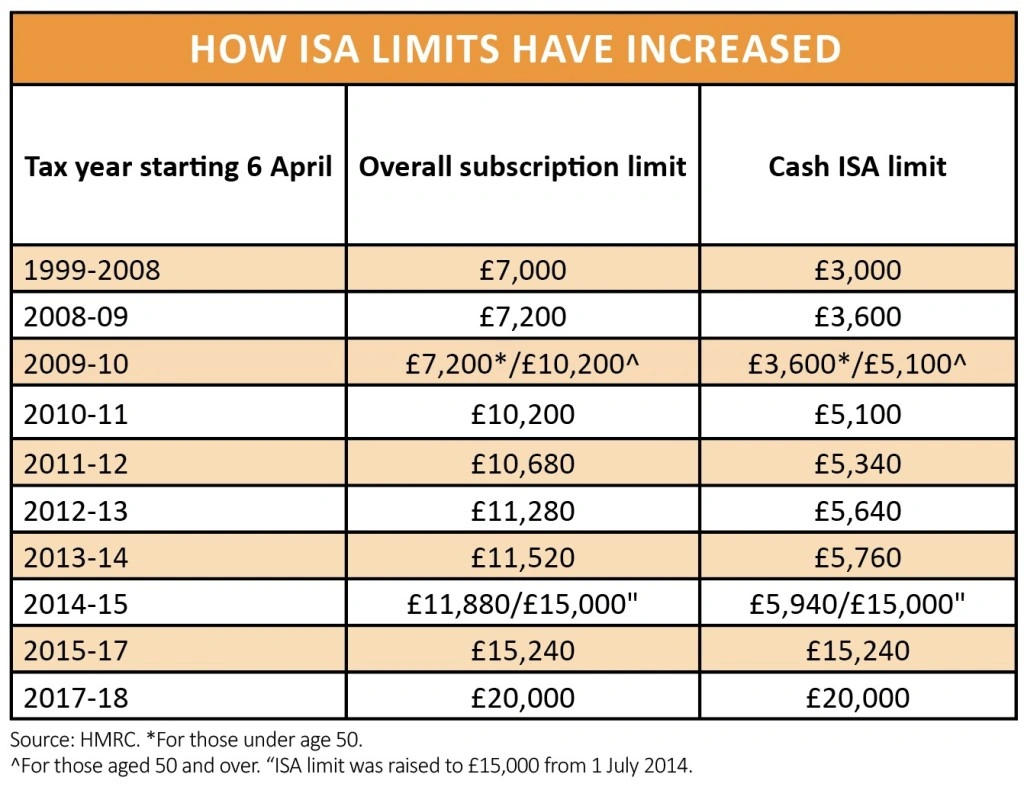

ISA Regulations Guidance Since the ISA regulations first came into force on 6 April 1999 there have been a significant number of changes to the scheme rules. Please note these Conditions only relate to stocks and shares ISAs. Aged 18 or over for a stocks and shares ISA.

The Complaints Management Framework of the Nigeria Capital Market shall address complaints arising out of issues that are covered under the Investments and Securities Act 2007 ISA the Rules and Regulations made pursuant to the ISA the rules and regulations of Securities Exchanges and guidelines of recognized trade associations. 2 These Rules shall regulate all securities exchange activities conducted on the NASD OTC market the Market and are applicable to activities relating to the conduct and. The concept of fit and proper is a fundamental regulatory concept.

Who can open an ISA. 188 Restriction on activities of managers. 187 Alteration of schemes and change of manager trustee or custodian.

Main arguments on behalf of the Securities Authority. You cannot be a joint holder of an LG ISA or an LG Junior ISA. 189 Publication of scheme particulars.

You must also be either. Buying a Condo on Sanibel. We expect most states to issue their final rules in the 2017-2018 range with an effective date between 2018 and 2020.

Conditions of a general permit under Section 49A to the Securities Law. You must be 18 or over but under 40 to open a Lifetime ISA. What are the ISA rules.

If you have invested any money into a cash ISA during the year the amount of that investment should be deducted from the limit of 20000. Pursuant to the Investments Securities Act ISA 2007 the Commission has reviewed and approved the following new Rules and Amendments to its existing Rules and Regulations as follows. Comply with and observe any Investment Services Rules and Regulations issued pursuant to the provisions of the ISA and applicable to the licence holder.

Resident in the UK. ISA Regulationsmeans the Individual Savings Account Regulations 1998 which currently apply to ISA investments as may be amended from time to time. For the current tax year the limit is 20000.

So to help you through the process Ive listed six things to become familiar with before you sign the line on your own Sanibel condo purchase agreement. Dividends you do not have to pay dividend or income tax on the dividends you receive from your ISA investments. Proposed rules and regulations.

You can open one cash ISA and one stocks and shares ISA each tax year. Capital Gains you do not have to pay Capital Gains Tax CGT on the growth of your investments within an ISA. Rules on Regulation of Derivatives Trading b.

If you dont use your annual Isa allowance before the end of each tax year youll lose it - and it will start anew on 6 April. For the 2021-22 tax year everyone has an Isa allowance of 20000 - this is the maximum amount youre allowed to pay into Isas between 6 April 2021 and 5 April 2022. You can choose whether you want to invest the whole lot in to one type of ISA or whether you want to split the allowance between different types.

Proposed rules and regulations. This Isa allowance is unchanged from 2020-21. 16 or over for a cash ISA.

However even if you choose to split it you cant invest more than a total of 20000 across the different types. Laws under the Supervision of the Authority. Interview prospective benefit providers.

ISA means an Individual Savings Account managed under the Regulations. These changes include increases to the ISA limits the introduction of new ISA types and numerous key amendments such as the introduction in recent years of flexible ISAs and the additional. Aged over 18 but under 40 for a Lifetime ISA.

18 or over for a stocks and shares or innovative finance ISA. The Regulations specify the individuals who may invest permitted investments and maximum investment limits and provide for accounts to be managed by the account managers. Investment Account with another person or persons.

ISA Transfers Inmeans a transfer of an existing ISA from Another Manager to the Account Manager conducted under. 186 Power to make regulations on the constitution and management of collective investment schemes. Junior ISA means a junior individual savings account in accordance with the Regulations.

Manage direct and coordinate the City benefits programs and service contracts including health dental life and accidental death insurance long-term disability vision plan AFLAC voluntary benefits and flexible spending accounts. Most people are encouraged to save as much as possible each year as any unused part of the yearly allowance cannot be carried forward into the next tax year. To open an ISA account you must be.

New Rule on Registration of Fixed Income Existing Securities. The plenum of the Authority approved a proposal to amend the liability sections of. 191 Representation against directive or its revocation.

This document will be available via your online Account. There are usually questions about insurance and association fees rules and regulations and of course rental restrictions. Investment Order Summary means a document which details the number of units you bought and the value.

You can therefore hold multiple cash ISAs as long as they were opened in separate tax years. The government sets the Individual Savings Account limits each tax year. Tower Semi Conductor Ltd.

Watch Out Avoid These 10 Isa Mistakes Now Shares Magazine

No comments